Credit Where it’s Due.

Having trouble getting a business loan from your bank? Have your credit facilities been reduced or declined?

Credit Review is here to help.

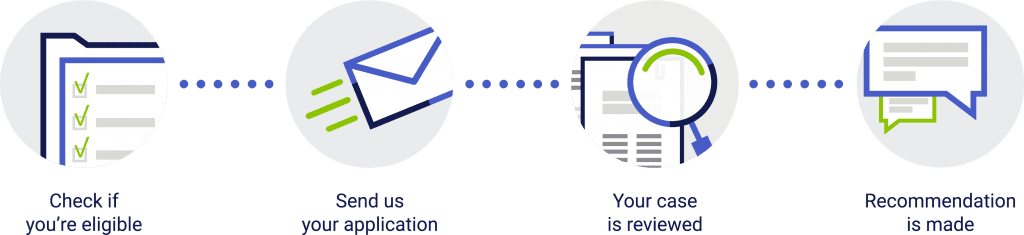

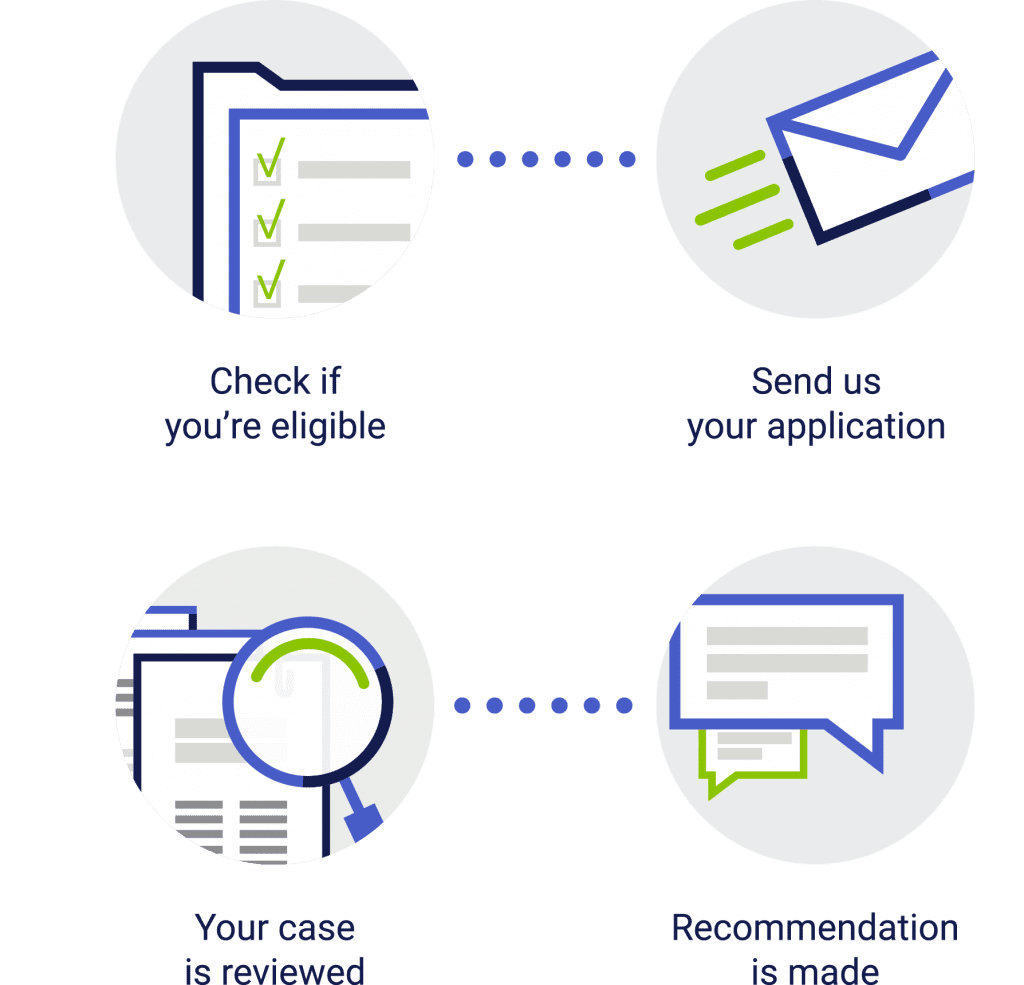

At Credit Review, we give practical support to Irish SMEs, sole traders and farm enterprises who have been refused a loan, whose credit facilities have been reduced or withdrawn or whose bank debt needs restructuring.

Over 80% Success Rate

Over 80% of the business owners we’ve supported have had unfavourable credit decisions by their banks overturned.

We Support Your Case

If we think you have a case, we ask the bank to provide the credit you need. Over 80% of the business owners we've supported have had unfavourable credit decisions overturned.

News

More News >Struggling to Secure Credit Finance for Your Commercial Vehicle?

Are you a commercial fleet operator facing challenges in securing the credit finance you need to keep your business moving? We understand the financial hurdles that need to be...

Having difficulties securing credit to expand your hotel or restaurant?

In the current economic landscape, hoteliers and restaurant owners can struggle to access the funds needed for growth. A detailed and compelling business plan highlighting your...